Loan Requirements and Repayment

Federal Direct Student Loans

Students that submit the FAFSA may qualify for federal student loans. Students must be enrolled at least half-time in an undergraduate or graduate degree program. Students are required to accept or decline all or a portion of the direct loan offered to them by accessing their financial aid award notification via their HIS portal.

According to Federal Regulations, students choosing to borrow their federal student loan(s) eligibility are required to complete Entrance Counseling and a Master Promissory Note (MPN) at the initial time of borrowing and Exit Counseling once graduating or ceasing to be enrolled at least half-time (www.studentaid.gov).

There are two types of federal direct student loans, subsidized and unsubsidized:

Subsidized loans are undergraduate loans only and do not accrue interest while the student is in school or in their six-month grace period as long as they remain enrolled at least half-time.

Unsubsidized loans are for both undergraduate and graduate students. They do accrue interest while a student is in school, but payments are not required on the loan until after the student graduates or drops below half-time enrollment.

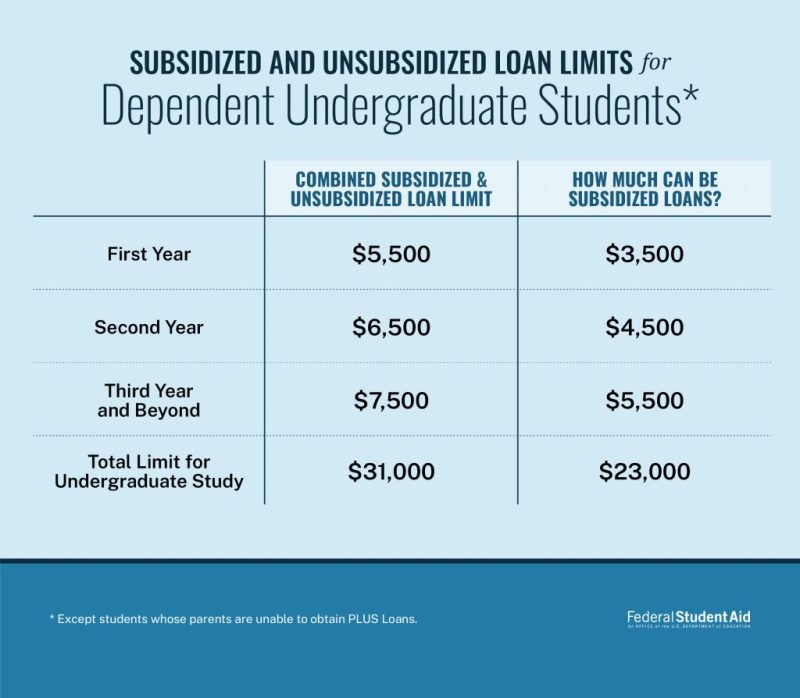

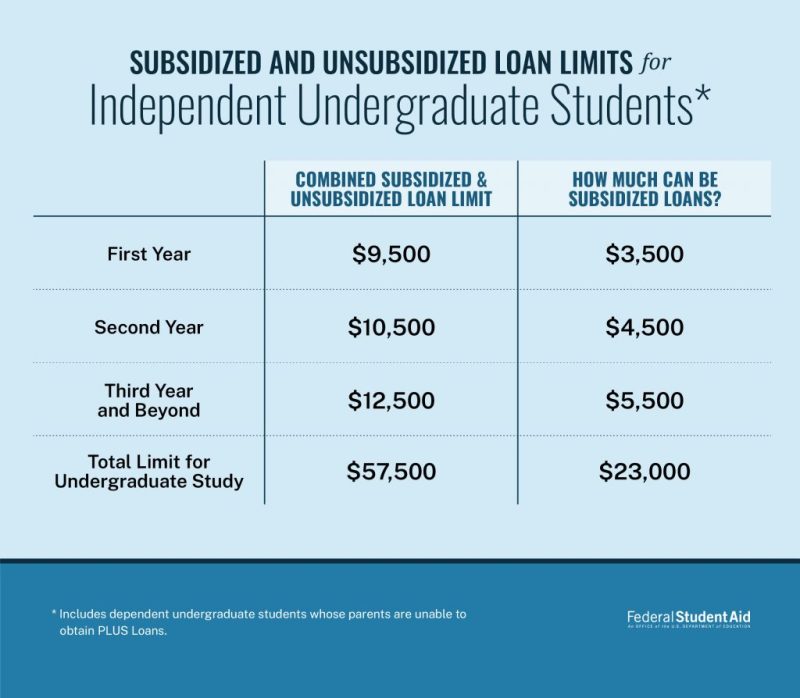

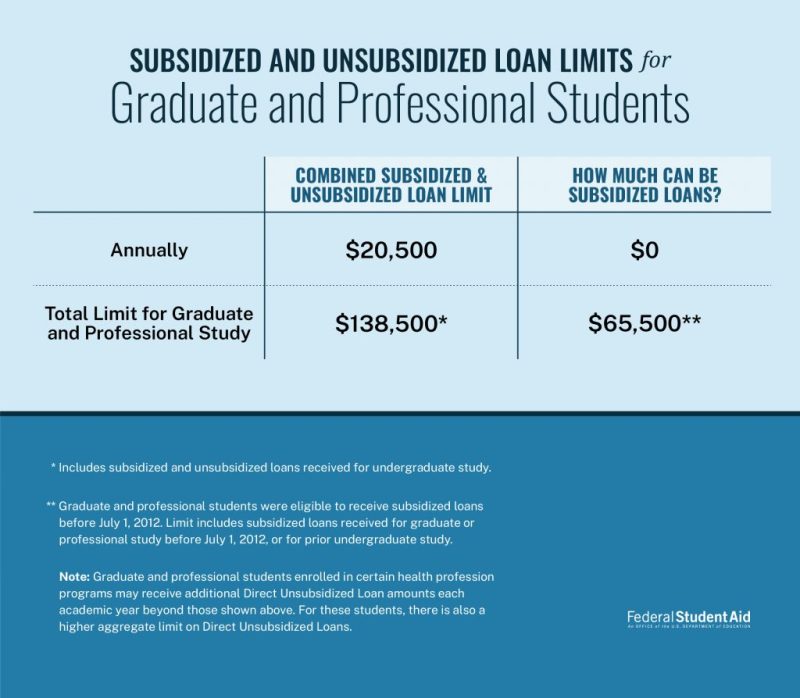

Undergraduate annual and aggregate (lifetime) loan limits can be found in the charts below:

** Please note, graduate unsubsidized borrow limits will be changing in July 2026.

More information on current interest rates and origination fees is available here: https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized.

Federal Direct Parent PLUS Loan

The Federal Direct Parent PLUS loan is a federal loan that parents of a dependent undergraduate student can borrow to help pay for college. The parent must not have any adverse credit history to borrow the loan. Parents may borrow the Direct Parent PLUS loan up $20,000 per academic year and $65,000 total within the total cost of attendance minus any other financial aid resources as of Fall 2026. Parents who borrow prior to the 2026-2027 academic year for their student may be able to stay under the previous regulations as long as their student remains in the same major with no breaks through the duration of their degree program. The loan must be applied for each academic year. Repayment begins while the student is enrolled, but parents have the option to defer repayment until the student graduates or ceases to be enrolled at least half-time.

More information on current interest rates and origination fees is available here: https://studentaid.gov/understand-aid/types/loans/plus/parent.

Federal Direct Graduate PLUS Loan**

The Federal Direct Graduate PLUS loan is a federal loan that graduate students may be able to borrow regardless of their demonstrated financial need. Graduate students must first borrow their maximum annual Direct Unsubsidized loan limit and may borrow the difference between the annual cost of attendance minus all other financial aid received. A credit check is performed during the application process. Students that have any adverse credit may be required to obtain an endorser. All Federal Graduate PLUS loan are placed in an in-school deferment status while the student is enrolled at least half-time. Students who graduate or cease to be enrolled at least-half time will be provided a one-time six-month grace period before repayment begins.

More information on current interest rates and origination fees is available here: https://studentaid.gov/understand-aid/types/loans/plus/grad.

** Please note, as of July 1, 2026, Federal Direct Graduate PLUS Loans are no longer available for new students. Returning students are only eligible if they remain in the same program/major with no breaks through the duration of their degree.

Federal Student Loan Repayment Information

The most common federal student loan is the Federal Direct Subsidized and/or Unsubsidized Loan. Graduate students may borrow a Federal Graduate PLUS loan in addition to a Direct Unsubsidized Loan. In the past, some of our students have borrowed a Federal Perkins Loan.

To learn more the various federal loan programs, visit the U.S. Department of Education’s loan information site here: https://studentaid.gov/understand-aid/types/loans)

The U.S. Department of Education outsources the servicing of its federal student loan portfolio to various companies. If you are unsure which company is servicing your federal loan, please log in to your federal student aid account’s dashboard at https://studentaid.gov.

More information about student loan servicers is available here: https://studentaid.gov/manage-loans/repayment/servicers.

Hollins University students who borrowed a Federal Perkins Loan and/or Hollins Hoge Loan are serviced by ECSI, a company located in Pennsylvania.

For information on your loan repayment options as a federal student loan borrower, please visit https://studentaid.gov/manage-loans/repayment/plans.

Are you interested in learning more about federal student loan forgiveness and cancellation options? If so, visit https://studentaid.gov/manage-loans/forgiveness-cancellation.